Freddie Mac Little Down Payments For Home Buyer Program

- What Is Required Down Payments For Home Loans

- How Much Down Payments For Home Loans

- Freddie Mac Little Down Payments For Home Buyer Programs

- Freddie Mac Little Down Payments For Home Buyer Program

- Down Payments For Home

Shutterstock

If you are shopping for a mortgage, you have probably seen all sorts of offers and advertisements aimed at first-time home buyers and wondered if these are really as good as they sound. In some cases, “first-time” programs are little more than attention-getting marketing messages from lenders, while in others they are actual assistance programs for people who may otherwise face challenges qualifying for a home mortgage or finding a home loan at an affordable interest rate. With this in mind, it is important to understand the difference between mortgage lender marketing programs, actual loan programs, and financial assistance programs.

You can be a first-time home buyer more than once

First of all, even if you have previously owned a home, you (or your spouse) may still qualify as a first-time home buyer. According to the U.S. Department of Housing and Urban Development, first-time home buyer status is not limited to people who have never owned a home before (although that criterion obviously applies). For lending purposes, a first-time home buyer includes anyone who fits one or more of these conditions:

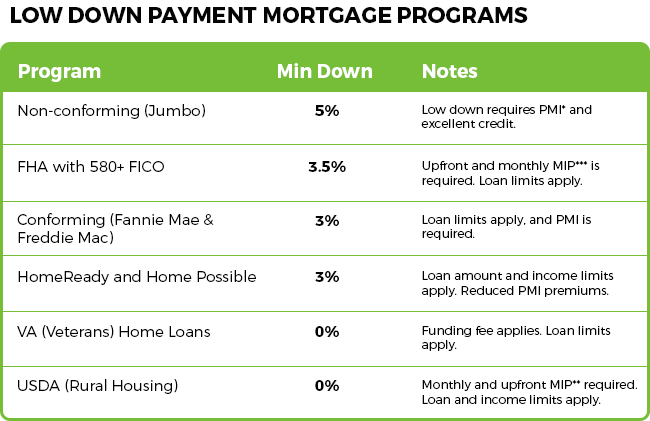

Dec 08, 2014 Hoping to broaden the pool of home buyers and boost the real estate market, Fannie Mae and Freddie Mac are launching mortgage programs with down payments as low as 3%. With Freddie Mac's Home Possible Advantage SM, qualified borrowers can make a down payment of as little as 3% Typically buyers make down payments of 5 to 20% of the purchase price. Forty percent of today’s homebuyers are making down payments that are less than 10%.

- An individual or a spouse who has not owned a primary residence for at least three years. This means married couples may qualify as first-time buyers even if only one of them meets this test.

- A single parent who previously only owned a home with a spouse while they were married.

- Someone who has only owned a primary residence that was not attached to a permanent foundation (e.g., a mobile home) in accordance with applicable regulations.

- Displaced homemakers whose only previous ownership was with a spouse.

- Someone who only owned property that was not in compliance with local building code ordinances and which cannot be improved to meet building code standards for less than the cost of constructing a new residence.

Types of programs

First-time home buyer programs can be broadly categorized as either loan programs or financial assistance programs. Both types of programs can be helpful to first-time home buyers. Loan programs, such as those backed by the Federal Housing Administration (FHA), are available to all borrowers through various commercial lenders, but they have features that may be particularly attractive to first-time buyers with lower credit scores or little in the way of cash savings. Private lenders may also offer attractive loan rates and terms for first-time home buyers with good credit and the ability to make larger down payments on a home purchase. Financial support programs for home buyers typically come from state and local government entities, although the federal government sometimes steps in to provide additional assistance during difficult economic times.

Loan programs

Mortgage loans are made by commercial lenders, such as banks, credit unions, or mortgage companies. These loans may be guaranteed by various organizations, to protect lenders against borrower defaults and also to make loans more affordable for borrowers.

- FHA. The Federal Housing Administration does not make loans, although they do insure loans made by commercial lenders to protect lenders if borrowers default on loan payments. FHA loans are available to all qualified buyers, and they can be particularly attractive to first-time home buyers because the qualifications are easier. For example, a potential home buyer with a credit score of at least 580 may qualify for an FHA loan with as little as 3.5% of the purchase price for a down payment. Lower credit scores between 500 and 579 may also qualify with a larger down payment of 10%, though the interest rate on the mortgage loan will be higher.

What Is Required Down Payments For Home Loans

- VA. The Veteran’s Administration (VA) also guarantees portions of home loans provided by private banks or mortgage companies to active duty service members, veterans, and eligible surviving spouses. A home purchase loan guaranteed by the VA can help military vets and spouses purchase homes at competitive interest rates without the need to also make a down payment or purchase private mortgage insurance. Applicants must have satisfactory credit scores, along with sufficient income to meet expected monthly loan payments.

- USDA Single Family Housing Guaranteed Loan Program. Similar to loan programs provided by FHA and VA, the United States Department of Agriculture (USDA) also provides loan guarantees to mortgage lenders so they can help borrowers with low and moderate incomes purchase homes in rural areas. The USDA program guarantees 90% of mortgage loan amounts for approved lenders to help offset the risk of offering 100% loans to eligible rural home buyers.

- Freddie Mac Home Possible® Mortgages. The Federal Home Loan Mortgage Corporation (also known as “Freddie Mac”) makes it possible for lenders to offer home loans to buyers with down payments as small as 3% through the Home Possible® Although this program is not limited to first-time home buyers, first-timers must first participate in a borrower education program.

Home Buying Financial Assistance

Financial assistance programs exist across all levels of government: city, state, and federal. These programs may provide assistance with funds for down payments, closing costs, or other expenses tied to the home purchase process.

- Fannie Mae’s HomePath Ready Buyer Program. In 2015 the Federal National Mortgage Association (FNMA or “Fannie Mae”) launched the HomePath Ready Buyer program, which provides first-time home buyers up to 3% of the home’s purchase price in the form of a rebate to assist with closing costs. Participants must complete an online home buyer education course in order to receive the 3% rebate.

- State-by-state home buyer programs. Many individual states sponsor a variety of home buyer programs designed to help first-time home buyers and others qualify for home mortgages. Visit your state’s housing website to find details for your area. For example, first-time home buyers with low or moderate incomes are eligible for the Texas Mortgage Credit Certificate Program as a way to convert mortgage interest into a federal income tax credit. New York state home buyers can take advantage of the Conventional Plus Program for down-payment assistance up to 3% of the home’s purchase price.

- City & county home buyer programs. Individual cities and municipalities can also offer assistance with home financing. For example, Miami/Dade County in Florida makes home financing assistance available to first-time home buyers through a loan program facilitated between Miami-Dade County Public Housing and Community Development and local mortgage lenders. Similarly, the Mayor’s Office of Housing and Community Development in San Francisco provides loan assistance programs for first-time home buyers. Consult with your city or county government offices for availability of similar programs.

As you review and evaluate the financial assistance or loan programs that may be a good fit for you, it is also a good idea to take inventory of your personal financial situation, such as checking your credit report (www.annualcreditreport.com), paying off credit cards and personal loans, and stashing more cash into your emergency fund. These tips and more are also available in this article: 5 Steps to Buying a Home.

'>If you are shopping for a mortgage, you have probably seen all sorts of offers and advertisements aimed at first-time home buyers and wondered if these are really as good as they sound. In some cases, “first-time” programs are little more than attention-getting marketing messages from lenders, while in others they are actual assistance programs for people who may otherwise face challenges qualifying for a home mortgage or finding a home loan at an affordable interest rate. With this in mind, it is important to understand the difference between mortgage lender marketing programs, actual loan programs, and financial assistance programs.

You can be a first-time home buyer more than once

First of all, even if you have previously owned a home, you (or your spouse) may still qualify as a first-time home buyer. According to the U.S. Department of Housing and Urban Development, first-time home buyer status is not limited to people who have never owned a home before (although that criterion obviously applies). For lending purposes, a first-time home buyer includes anyone who fits one or more of these conditions:

- An individual or a spouse who has not owned a primary residence for at least three years. This means married couples may qualify as first-time buyers even if only one of them meets this test.

- A single parent who previously only owned a home with a spouse while they were married.

- Someone who has only owned a primary residence that was not attached to a permanent foundation (e.g., a mobile home) in accordance with applicable regulations.

- Displaced homemakers whose only previous ownership was with a spouse.

- Someone who only owned property that was not in compliance with local building code ordinances and which cannot be improved to meet building code standards for less than the cost of constructing a new residence.

Types of programs

First-time home buyer programs can be broadly categorized as either loan programs or financial assistance programs. Both types of programs can be helpful to first-time home buyers. Loan programs, such as those backed by the Federal Housing Administration (FHA), are available to all borrowers through various commercial lenders, but they have features that may be particularly attractive to first-time buyers with lower credit scores or little in the way of cash savings. Private lenders may also offer attractive loan rates and terms for first-time home buyers with good credit and the ability to make larger down payments on a home purchase. Financial support programs for home buyers typically come from state and local government entities, although the federal government sometimes steps in to provide additional assistance during difficult economic times.

Loan programs

Mortgage loans are made by commercial lenders, such as banks, credit unions, or mortgage companies. These loans may be guaranteed by various organizations, to protect lenders against borrower defaults and also to make loans more affordable for borrowers.

- FHA. The Federal Housing Administration does not make loans, although they do insure loans made by commercial lenders to protect lenders if borrowers default on loan payments. FHA loans are available to all qualified buyers, and they can be particularly attractive to first-time home buyers because the qualifications are easier. For example, a potential home buyer with a credit score of at least 580 may qualify for an FHA loan with as little as 3.5% of the purchase price for a down payment. Lower credit scores between 500 and 579 may also qualify with a larger down payment of 10%, though the interest rate on the mortgage loan will be higher.

- VA. The Veteran’s Administration (VA) also guarantees portions of home loans provided by private banks or mortgage companies to active duty service members, veterans, and eligible surviving spouses. A home purchase loan guaranteed by the VA can help military vets and spouses purchase homes at competitive interest rates without the need to also make a down payment or purchase private mortgage insurance. Applicants must have satisfactory credit scores, along with sufficient income to meet expected monthly loan payments.

How Much Down Payments For Home Loans

- USDA Single Family Housing Guaranteed Loan Program. Similar to loan programs provided by FHA and VA, the United States Department of Agriculture (USDA) also provides loan guarantees to mortgage lenders so they can help borrowers with low and moderate incomes purchase homes in rural areas. The USDA program guarantees 90% of mortgage loan amounts for approved lenders to help offset the risk of offering 100% loans to eligible rural home buyers.

Freddie Mac Little Down Payments For Home Buyer Programs

- Freddie Mac Home Possible® Mortgages. The Federal Home Loan Mortgage Corporation (also known as “Freddie Mac”) makes it possible for lenders to offer home loans to buyers with down payments as small as 3% through the Home Possible® Although this program is not limited to first-time home buyers, first-timers must first participate in a borrower education program.

Home Buying Financial Assistance

Financial assistance programs exist across all levels of government: city, state, and federal. These programs may provide assistance with funds for down payments, closing costs, or other expenses tied to the home purchase process.

- Fannie Mae’s HomePath Ready Buyer Program. In 2015 the Federal National Mortgage Association (FNMA or “Fannie Mae”) launched the HomePath Ready Buyer program, which provides first-time home buyers up to 3% of the home’s purchase price in the form of a rebate to assist with closing costs. Participants must complete an online home buyer education course in order to receive the 3% rebate.

- State-by-state home buyer programs. Many individual states sponsor a variety of home buyer programs designed to help first-time home buyers and others qualify for home mortgages. Visit your state’s housing website to find details for your area. For example, first-time home buyers with low or moderate incomes are eligible for the Texas Mortgage Credit Certificate Program as a way to convert mortgage interest into a federal income tax credit. New York state home buyers can take advantage of the Conventional Plus Program for down-payment assistance up to 3% of the home’s purchase price.

Freddie Mac Little Down Payments For Home Buyer Program

- City & county home buyer programs. Individual cities and municipalities can also offer assistance with home financing. For example, Miami/Dade County in Florida makes home financing assistance available to first-time home buyers through a loan program facilitated between Miami-Dade County Public Housing and Community Development and local mortgage lenders. Similarly, the Mayor’s Office of Housing and Community Development in San Francisco provides loan assistance programs for first-time home buyers. Consult with your city or county government offices for availability of similar programs.

Down Payments For Home

As you review and evaluate the financial assistance or loan programs that may be a good fit for you, it is also a good idea to take inventory of your personal financial situation, such as checking your credit report (www.annualcreditreport.com), paying off credit cards and personal loans, and stashing more cash into your emergency fund. These tips and more are also available in this article: 5 Steps to Buying a Home.